View affordable Indiana Health Insurance Marketplace rates for individuals, families, small businesses and the self-employed. Medicare Supplement, Advantage, Medigap, and Part D prescription drug plans are offered to Seniors that are Medicare-eligible. Quality coverage and benefits are available from many of the nation’s top carriers. Healthy Indiana Plan (HIP) is also offered to eligible applicants.

We provide the lowest online prices for subsidized Obamacare policies and unsubsidized plans for your medical coverage. Instantly compare free 2026 online quotes from multiple companies for the entire Hoosier State. Anthem, Aetna, Cigna, Ambetter, UnitedHealthcare, and Caresource offer private plans. US Health And Life exited the Marketplace two years ago.

Policies are approved by the Indiana DOI. Qualified applicants may receive a large premium tax credit (PTC) that can potentially reduce the monthly rate to $0. The PTC can be used during the enrolled process (APTC) to immediately reduce the premium. Cost sharing reductions (CSR) can be utilized for Silver-tier plans to lower copays, deductibles, coinsurance, and maximum out-of-pocket expenses. Only Marketplace plans are eligible for subsidies. Catastrophic-tier coverage does not receive subsidies.

UnitedHealthcare, Allstate (formerly National General), and other carriers offer unsubsidized coverage, including short-term options. Temporary plans are typically very inexpensive, and are offered throughout the entire year. Pre-existing conditions are not covered and applicants must complete a very short application to secure coverage. Benefits can begin the day after the policy is approved. However, due to recent legislation, duration of coverage is limited to four months.

The least-expensive available ACA plans are: Anthem Bronze Essential 9200, Anthem Bronze Essential 5500, Anthem Heart Healthy Bronze Essential 4500, Anthem Bronze Essential 7500 Standard, Anthem Bronze Essential POS 7500 Standard, CareSource Low Premium Bronze 9200, CareSource Bronze First 7500, Ambetter Standard Expanded Bronze, Ambetter Everyday Bronze, Ambetter Choice Bronze HSA, Cigna Bronze 7000 Indiv Med Deductible Enhanced Diabetes Care, Cigna Bronze CMS Standard, Cigna Connect Bronze 8550 Indiv Med Deductible, Cigna Connect Bronze 3800 Indiv Med Deductible, Aetna Bronze S, UnitedHealthcare Bronze Standard, UnitedHealthcare Bronze Value, and UnitedHealthcare Bronze Copay Focus $0 Indiv Med Ded Ded.

2026 Indiana Rate Change Requests:

Ambetter – 42.94% increase

Ambetter + Vision + Adult Dental – 41.76% increase

Ambetter Off-Exchange Only – 24.29% increase

Ambetter Health Solutions – 19.82% increase

Ambetter Health Solutions + Vision + Adult Dental – 21.27% increase

Anthem HMO With Pediatric Vision – 20.97% increase

Anthem POS With Pediatric Vision – 25.40% increase

CareSource Marketplace – 27.46% increase

CareSource Marketplace Adult Vision And Fitness – 28.20% increase

Cigna IN_IND_EPO – 34.95% increase

UnitedHealthcare IND EPO – 41.35% increase

UnitedHealthcare IND EPO ADAV – 39.94% increase

Indiana Senior Medicare Options

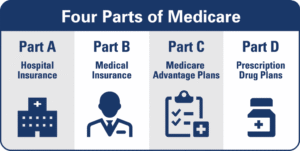

You can also review Senior Indiana Medicare Supplement plans and other Medigap options. If you have reached age 65, many policies are available to help pay out-of-pocket expenses that original Medicare benefits (Parts A and B) do not cover. Part D prescription drug plans (PDPS) are also offered by many companies along with several Advantage (MA) contracts. Consumers have many rights and protections, along with 10 standardized plans to choose from, and retirees can review customized options.

Indiana Medicare Supplement Coverage

Recent changes impact availability of some plans. A high-deductible (HD) plan G is available with a $2,870 deductible. Plan F (HD) continues to be offered for existing customers. Once the deductible is met, the plan provides identical benefits as Plan G. Several Plan B benefits include Part B excess charges, Part B coinsurance payment, and Part A coinsurance and hospital costs (up to 365 days after Medicare benefits are used). Plan F, G, and N are additional popular MediGap choices.

Current Medigap Monthly Rates (Female Age 65 Marion County)

Plan A – $94 (Mutual Of Omaha)

Plan B – $139 (Aetna)

Plan C – $135 (New Era Life)

Plan D – $198 (United American)

Plan F – $119 (Atlantic Capital Life)

Plan F (HD) – $31 (New Era Life)

Plan G – $100 (Cigna)

Plan G (HD) – $31 (New Era Life)

Plan K – $59 (AARP-UnitedHealthcare)

Plan L – $103 (AARP-UnitedHealthcare)

The highest-rated Medicare Advantage (MA) plans in Indiana include: Aetna Medicare Eagle, Aetna Medicare SmartFit, Aetna Medicare Value, Aetna Medicare Value Plus, Aetna Medicare Essential, Aetna Medicare Enhanced Select, Aetna Medicare Premier, UnitedHealthcare Nursing Home Plan, UnitedHealthcare Complete Care, UnitedHealthcare Dual Complete, AARP Medicare Advantage Patriot No Rx, AARP Medicare Advantage Essentials from UHC, AARP Medicare Advantage Extras from UHC, AARP Medicare Advantage Giveback from UHC, Humana Gold Choice, Humana USAA Honor Giveback, Wellcare Assist, Wellcare Simple, Zing Select Diabetes And Heart Complete, Zing ESRD Select IN, Zing Select Care IN, Red, White, and Tru, My TruAdvantage Select Plus, My TruAdvantage Choice Plus, and My TruAdvantage Select.

The MA plans with the largest enrollments are: Anthem Dual Advantage, Anthem Medicare Advantage (HMO), Anthem Medicare Advantage (PPO), Anthem Medicare Advantage 2, Anthem Full Dual Advantage Aligned (HMO), Anthem Extra Help (HMO), Humana USAA Honor Giveback with Rx (PPO), AARP Medicare Advantage Essentials from UHC IN-12 (HMO), AARP Medicare Advantage from UHC IN-0002 (PPO), AARP Medicare Advantage from UHC IN-0007 (PPO), Humana Gold Plus (HMO),HumanaChoice Giveback (HMO), Humana Gold Plus Integrated SNP-DE (HMO), UHC Dual Complete IN-S001 (PPO), UHC Dual Complete IN-D001 (PPO), UHC Dual Complete IN-S002 (PPO), Humana USAA Honor Giveback (PPO), and IU Health Plans Medicare Flex Network (HMO), Aetna Medicare Eagle.

The least expensive prescription drug (Part D) plans in Indiana are: Wellcare Value Script, Cigna Healthcare Saver Rx, Humana Value Rx, Wellcare Classic, SilverScript Choice, Humana Basic Rx, AARP Medicare Rx Saver From UHC, Anthem MediBlue Rx Plus, and Cigna Healthcare Assurance Rx. 16 drug plans are offered in Indiana for 2025. Two plans have monthly premiums under $25, and two $0 deductible contracts are offered. The average monthly premium of all available plans is $65.29. The LIS Benchmark Premium is $49.58.

Medicare Supplement plans are offered by many carriers. Plans G and F are very popular while Plan G (HD) provides the lowest premium. Once the $2,870 annual deductible has been met, benefits are equal to a Part G plan and 100% of approved services are covered. The $257 Part B annual deductible is included in the HD plan. Part B benefits include preventative and medically-necessary services. Note: Carriers that offer Plan G (HD) plans include New Era Life, United American, Atlantic Capital Life, Medico, Humana, and Cigna.

Under 65 Plans With Low Deductibles

Regardless if you own your own business, you’re buying a policy for the first time, or simply can not afford your existing plan, you can compare multiple PPO, EPO, and HMO policies with the best prices on our website. Easily and quickly obtain the information you are looking for, apply, and enroll for benefits and get covered. We show you the amount of federal subsidy you are eligible for, and which plans you should choose. You can also select policies that are not subsidized by the federal government.

Comprehensive office visit copay, low-deductible, and inexpensive catastrophic plans are offered, and CareSource offers plan options in 92 counties for applicants under age 65. Qualification for an ACA subsidy can reduce policy deductibles below $1,000 and office visit copays as low as $5. Monthly payments can also reduce to $0. Anthem’s 2025 rates are extremely competitive, and coupled with the federal subsidy, many $0 premium plans are offered.

Silver-tier plans utilize cost-sharing to reduce out-of-pocket expenses. Deductibles, copays, and premiums can substantially reduce, depending on household income. Plan options include Ambetter Standard Silver, Ambetter Clear Silver, Ambetter Focused Silver, Anthem Silver Essential 7000, Anthem Heart Healthy Silver Essential 4500, Anthem Silver Essential 5000 Standard, Cigna Connect Silver 7000 Indiv Med Deductible, Cigna Connect Silver CMS Standard, Aetna Silver 5 Advanced, Aetna Silver S, CareSource Low Premium Silver 6000, CareSource Silver 5000, UnitedHealthcare Silver Value, and UnitedHealthcare Silver Standard.

Temporary Indiana healthcare is also available during and after the Marketplace Open Enrollment period. Premiums are typically very low, and policies can be issued within 24 hours. However, pre-existing conditions are not covered and the policy duration is limited. A maximum of four months of coverage is offered, and the instant federal tax credit is not applicable to these plans. Sample monthly rates for a 30-year-old female are shown below:

$80 – Pivot Health Economy 10000 – $10,000 deductible and 20% coinsurance.

$89 – Pivot Health Choice 10000 – $10,000 deductible and 20% coinsurance. $30 and $60 office visit copays.

$91 – Everest Flex $10,000 50/50% – $10,000 deductible and 50% coinsurance. $50 office visit copays.

$95 – Pivot Health Economy 5000 – $5,000 deductible and 20% coinsurance.

$115 – Everest Flex $2,5000 50/50% – $2,500 deductible and 50% coinsurance. $50 office visit copays.

$153 – UnitedHealthcare Short Term Medical Value – $7,500 deductible and 30% coinsurance.

Healthy Indiana Program (HIP)

HIP is operated by the State of Indiana and is offered in all counties. Medical, dental, and vision coverage is generally available. The income limit for qualification is approximately $21,603 (individuals), Couples ($29,198) and families of four ($44,376). Each year, the POWER account (Personal Wellness And Responsibility) pays the first $2,500 a covered person’s medical expenses. A small portion of the account is paid by the consumer, and not the government. Contributions made inside the account are not lost if you exit the program early.

If you have smaller than expected medical expenses at the end of the calendar year, you may roll over fund to be used the following year. Completing designated preventative services can also increase the amount of funds in the POWER account. Non-profit organizations and employers are permitted to make contributions up to the full amount. A network provider list can be easily accessed to verify your doctor or hospital is in-network.

HIP Basic provides medical coverage for households with members that have income equal or less than 100% of the Federal Poverty Level (FPL). It is assumed that there are no POWER contributions. ESB (Essential Health Benefits) are included but dental, hearing, and vision coverage must be separately purchased. Copays are $8 for non-emergency ER visits, $4 for office visits and outpatient services, $75 for hospital stays and inpatient services, $4 for preferred drugs and $8 for non-preferred drugs.

HIP Plus is the most economical of both options. Comprehensive coverage also provides dental and vision benefits. A monthly POWER deposit is made. The amount is directly proportional to the income and no copays for services are required. POWER account contributions can be made by cash, money order, check, electronic funds transfer, or online payment through a web portal. However, utilizing the ER for a non-emergency situation will result in out-of-pocket expense.