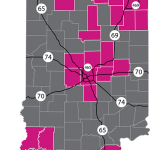

Ambetter individual and family healthcare coverage in Indiana provides affordable options in 28 counties. The parent company, Managed Health Services (MHS) has been providing quality medical coverage to Hoosier residents for 21 years. Marketplace policies can easily be purchased, and rates are often lower thanother major carriers, such as UnitedHealthcare and Anthem Blue Cross and Blue Shield.

About The Parent Company MHS

MHS is a managed care provider that helps operate the Children’s Health Insurance Program (CHIP), Hoosier Healthwise, and Healthy Indiana. In addition to enrollment duties, they coordinate community events and provide public information about existing and future programs. The National Committee For Quality Assurance (NCQA) has awarded its “commendable” designation to MHS for outstanding services.

MHS is actually a wholly-owned subsidiary of Centene Corporation, which is a Fortune 500 company specializing in providing services to government-funded programs for consumers that are without medical coverage. Some of these programs include Medicaid, Aged, Blind, or Disabled (ABD), and CHIP. Other specialties include managed vision, in-home treatment, special-needs coverage through Medicare, and prescription benefits management.

With offices in Indianapolis, Fort Wayne, and Merrillville, Ambetter offers low-cost healthcare throughout much of the state. The 28 participating counties are Adams, Allen, DeKalb, Elkhart, Huntington, Kosciusko, Marshall, St. Joseph, Wells, Whitley, Boone, Clarke, Daviess, Hamilton, Handcock, Harrison, Hendricks, Henry, Howard, Johnson, Knox, Lake, LaPorte, Madison, Marion, Miami, Montgomery, Porter, Pulaski, Steuben, Tippecanoe, and Vanderburgh.

Network Providers

The network provider list is quite extensive, and includes primary care physicians, specialists, Urgent-Care locations, hospitals, and many other medical and rehabilitation and treatment facilities. For example, if you lived in the Indianapolis area, the following hospitals would be considered “in-network.” We used a 40-mile radius.

Community Hospital East

Westview

Community Hospital South

Community Hospital North

Heart and Vascular

Community Hospital East

Hendricks Regional

Johnson Memorial

Riverview

Hancock Memorial

Witham Memorial

Community Hospital Of Anderson

Putnam County

What About Doctors?

The availability of primary care physicians (PCP) allows you to choose from many doctors within your area. Specialists, behavioral health, dental and vision options are also plentiful. We listed below the number of network PCPs in several large and small cities. After each city, shown is the number of providers within a 20-mile radius. Typically, the number of available providers increases each year. NOTE: A 24/7 nurse advice line is also available. Registered and licensed nurses can provide professional assistance to current policyholders.

Bloomington – 5

Brownsburg – 172

Carmel – 198

Evansville – 12

Fort Wayne – 95

Hammond – 106

Indianapolis – 212

Lafayette – 5

La Porte – 25

Lebanon – 73

Muncie – 54

Richmond – 4

South Bend – 144

Valparaiso – 194

Vincennes – 26

NOTE: You can also search for your Ambetter provider here.

“Start Smart” For Pregnant Women

Pregnant women benefit from a special program designed to provide support, education, and guidance. A “Notification Of Pregnancy” (NOP) form is required to be completed before services are provided. Maintaining healthy lifestyle habits, resting regularly, and avoiding drugs, alcohol, and tobacco products are often discussed. Counseling and therapy can also be provided.

Wellness Benefits That Pay You

Current policyholders are rewarded by participating in preventative activities and maintaining good health. A prepaid credit card (My Health Pays Visa Prepaid Card) is utilized to accumulate your earned dollars. The reward points can be used to pay many common out-of-pocket costs, such as physician copays, deductibles, coinsurance and your premium each month. NOTE: Prescription copays are not part of the program.

Common items that are available for accumulating dollars include:

$50 – Completing initial “Welcome” survey.

$25 – Annual flu shot.

$20 – Monthly reimbursement for visiting exercise facility or gym at least eight times.

$50 – Annual wellness exam.

Additionally, discounts and price reductions on gym memberships and health clubs are offered. Zumba, Schwinn, and Stairmaster products also may be available at lower pricing.

2017 Ambetter Indiana Marketplace Plans (Vision And Adult Dental Benefits Can Be Added To Most Plans)

Policies are divided into three tiers. Essential (Bronze) covers basic needs, with emphasis on major medical expenses. Premiums are the lowest but out-of-pocket costs are the highest. Balanced (Silver) offers lower rates and less risk for large claims. If you qualify for a subsidy, this tier is often the best option because of “cost-sharing” that reduces the copay and deductible. Secure (Gold) policies are the most expensive, but also feature the lowest copays, coinsurance, and deductibles.

Bronze Tier

Essential Care 1 – Least expensive plan in portfolio. $6,800 deductible with 0% coinsurance. Thus, maximum out-of-pocket cost per individual is $6,800. Generic drugs ($20 copay) are not subject to the deductible. An annual eye exam and one pair of glasses included (no copay) for children.

Silver Tier

Balanced Care 4 – $30 and $60 office visit copays, with Urgent Care copay of $100. Deductible is $7,050 with maximum out-of-pocket expenses of $7,050 and 0% coinsurance. Generic and preferred brand copays are $15 and $50. Non-preferred and specialty drugs must meet deductible.

Gold Tier

Secure Care 1 – $1,000 deductible with $6,350 maximum out-of-pocket expenses. Three free pcp office visits are allowed although specialist visits must meet the deductible first. A $500 deductible also applies to all prescriptions except generic drugs ($10 copay). There is also a 20% coinsurance once the deductible has been met.

NOTE: On selected plans, three free PCP visits can be added. When this option is selected, a deductible does not apply to unexpected doctor visits for flu and other symptomatic expenses. Preventive benefits are covered at 100% on all Metal plans without a copay, coinsurance, deductible or waiting period.

Federally Subsidized Plans

If your household family income is less than 400% of the Federal Poverty Level (FPL), and you are not offered “affordable” medical coverage from an employer, you are probably eligible for financial aid to help pay your premium. These subsidies become larger as the size of your family grows. Thus a six-person household could qualify for as much as $400-$600 per month more in aid than a two-person household.

The actual amount of your instant tax credit is based on the cost of a “Silver-tier” policy in your designated area. Of course, you can also purchase a Gold, Platinum, or Bronze plan. A “catastrophic” plan requires the applicant to be under 30 years old. NOTE: Although the subsidy instantly reduces your premium, you may also elect to defer the credit and receive a refund the following year when you file your tax return. However, if you underestimate your income, you will have to pay part of the subsidy back.

How Rates Compare With Other Companies

Our “sample” household is a a 43 year-old single person living in Hendricks County with an annual estimated income of $30,000. We have illustrated below several rates (monthly) from the most competitively-priced plans:

$145 – Ambetter Essential Care 1

$149 – Ambetter Essential Care 2

$158 – Anthem Pathway X 0

$182 – Anthem Pathway X 5750

$191 – MDwise Marketplace

$194 – CareSource Just4Me Healthcare With Heart

$206 – Ambetter Balanced Care 2

$230 – Anthem Pathway X 10

Senior Plans (Medicare Supplement and Medicare Advantage)

Ambetter does not offer these types of contracts at this time. Persons that have reached age 65 and are Medicare-eligible, can compare the most popular plan options throughout our website. The Open Enrollment period is different than the Under-65 period.

Latest News

January 2015 – Managed Health Systems (MHS) will be working with Medicaid-eligible residents who meet the requirements of Hoosier Care Connect, which begins in April of 2015. More than 80,000 older, disabled or blind persons will be participants in the program. More than 10,000 doctors and specialists will help with the treatment. MHS has almost 20 years of experience working with Medicaid patients in the state.

August 2015 – Projected 2016 rates are expected to reduce as much s 7%, according to initial filings. Celtic (Actually Celticare) will now be involved in the underwriting and distribution of products. However, Celtic no longer offers policies under their own brand name.

October 2015 – Ambetter’s individual plan portfolio is more streamlined for 2016. Also, prices, which were already competitive, have become more attractive compared to Anthem and other carriers. Increased preventative care benefits will also reduce expenses for many customers.

November 2015 – The most recent Formulary Drug Guide has been released. Generic drugs, which have the same active ingredients as brand-name drugs, should always be considered first. There are five tiers of prescriptions, ranging from 0 (typically free preventative drugs) to 4 (expensive specialty drugs). The complete listing can be found here.