Last Updated on by SiteControl

Can you get free health insurance in Indiana? A legitimate policy that covers office visits, prescriptions, hospital stays, the ER, maternity and most other medical expenses? Thanks to the ACA legislation, the Indiana Health Exchange and “The Affordable Care Act,” Hoosier residents can qualify for the federal subsidy that can potentially pay up to 100% of premiums. Many persons refer to this as a very gratuitous Marketplace. The larger your household, the higher your federal subsidy. Also, many Silver-tier plans that qualify for “cost-sharing” will feature very low deductibles and copays.

Who Gets Free Coverage?

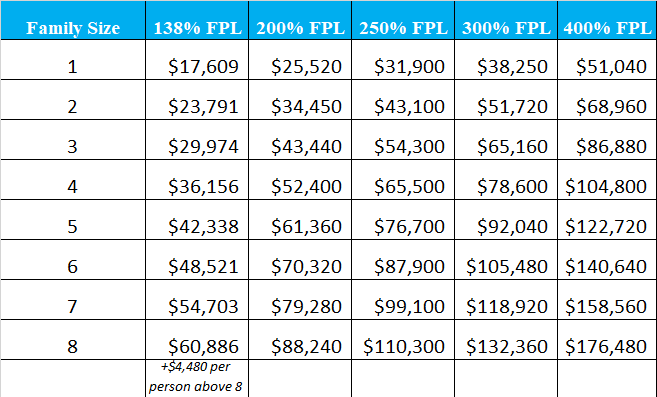

Actually, millions of persons qualify for this benefit. Under the ACA legislation, your household income and how it relates to the “Federal Poverty Level” calculation (FPL) determines how much financial aid you will receive. If the amount is between 100% and 400% of the FPL. you’re entitled to assistance. You can possibly qualify for Medicaid (ages 19-64) if you are at or below 138% of the FPL. You would not have to pay for coverage, and you could transfer benefits to Medicaid when you turn age 65.

The 2025 monthly household income limit for HIP Plus eligibility is listed below:

One-member household – $1,732

Two-member household – $2,351

Three-member household – $2,970

Four-member household – $3,588

Five-member household – $4,207

Six-member household – $4,826

Seven-member household – $5,444

Eight-person household – $6,064

($618 per additional person)

The monthly household income limit for HIP Basic eligibility is listed below:

One-member household – $1,255

Two-member household – $1,704

Three-member household – $2,152

Four-member household – $2,600

Five-member household – $3,049

Six-member household – $3,497

Seven-member household – $3,945

Eight-person household – $4,394

($448 per additional person)

For incomes above the 138% level, using the diagram a few paragraphs below, substantial amounts of your Indiana healthcare costs will be covered. For example, a 30 year-old single person (residing in Indianapolis) making about $32,000 per year can purchase a “Bronze” level policy for about $25 per month. A Silver option keeps the premium under $70 per month. At age 45, the monthly premiums would actually reduce to less than $15 for the Bronze option, and less than $65 for the Silver option, since the federal subsidy increases. Recent pandemics (COVID) often result in increased government subsidies to pay your health insurance premium.

At $36,000 of income per year, the same 30 year-old pays about $57 and $106 respectively per month for the two plans. However, with one child added, the dependent may be eligible for CHIP. That’s free healthcare in Indiana, courtesy of the federal subsidy. Of course, higher-income households with no medical issues, are sometimes forced to pay for benefits that previously were not needed or required.

Platinum and Gold options are available, and have lower deductibles and copays. However, prices are higher, and they typically are most cost-effective for high-income earners with expensive treatment resulting from existing conditions. Prescription coverage is much more robust on these types of plans, and copays and coinsurance are often smaller compared to Bronze plans. Since maximum out-of-pocket expenses are also sometimes lower, chronic disease prescription drugs are fully covered much quicker.

Higher Incomes

For higher incomes, premiums increase. For example a single 40 year-old residing in Indianapolis with an income of $60,000 per year receives no aid for the Silver plan, and the least expensive rate is approximately $385 per month. However, a Bronze option costs only $330 per month.

For bigger families, the subsidy becomes much greater. Based on $85,000 of household income and a family of four (parents ages 45 with two children), a Silver plan costs about $347 per month. A Bronze plan would only cost about $331.

However, if the parents are age 55 (still two children and same income), the cost of the Silver plan remains relatively unchanged at $343, and the cost of the Bronze plan is only $149! Reducing the household income to $80,000 will result in a whopping subsidy of more than $12,000! Your monthly cost for a Silver plan becomes only $280 per month!

If you have a larger family, you will receive substantial maximum financial help. Let’s use an example of 50 year-old parents with five children between the ages of 1 and 18. The household income is $90,000. All children may be eligible for CHIP benefits. However, at the $100,000 income level, a subsidy of approximately $1,600 per month is offered since no CHIP coverage is available.

NOTE: We used Marion County for the previous examples. Graph courtesy of NHL.

Buying Coverage Away From The Exchange

If your higher income prohibits you from qualifying for a tax subsidy, you could be facing large premiums. If you are not being treated for any conditions, you will probably pay for benefits that won’t be utilized. But there is help.

However, “Off-Marketplace” policies are designed for residents with larger disposable incomes. Doctors and specialists are usually more accessible since the carriers can often negotiate attractive deals with providers. Pediatric dental services are also required as part of the “Essential Benefits” packet of coverage. But rates on these plans are sometimes less than what is otherwise available. And many of the largest companies offer these policies as options.

Medicaid In Indiana

With Medicaid expansion, the HIP (Healthy Indiana Plan 2.0) has provided coverage for almost 400,000 persons. This program serves low income residents of the Hoosier state that make too much money to qualify for Medicaid. It’s similar to an HSA since contributions are made to a savings account (POWER) and all preventive services are covered in full.

Incentives are offered to maintain good health, and persons between the ages of 19-64 are eligible. About 70% of all persons eligible to make contributions are taking advantage of this great feature. Also, the number of available network doctors and other facilities is quite large compared to other State programs. Since the number of companies that offer qualified Exchange coverage has gradually reduced the last four years, this program has become more popular.

To be eligible for Medicaid, the requirements are fairly straightforward. The main eligibility criteria is based on how much money you make (from all sources including social security and disability) and the number of family members that will be covered. Your age (see above) is also a factor since specific programs are designed to cover children and/or young adults. SNAP (food stamps) and TANF (cash assistance) may be offered, depending on family income and assets. Maximum annual income to qualify is $16,954 for an individual, $22,987 for a couple, and $35,053 for a family of four.

Sometimes, the amount of money you have (checking and savings accounts plus other assets) plus your existing medical conditions will be considered. For example, if you are being treated for a chronic illness, you may qualify for an option different than someone with no major issues. Applications can be submitted or by visiting a local DFR office. If you are approved, a welcome packet with helpful tips and instructions is sent to your home.

Senior Indiana Medicaid Long Term Care Eligibility

Nursing Home/ Institutional

Single income limit is $2,349 per month, asset limit is $2,000, and required level of care is help with three activities of daily learning.

Married with one spouse applying limit is $2,349 per month, asset limit is $2,000 ($128,640 for non-applicant), and required level of care is help with three activities of daily learning.

Married with both spouses applying limit is $2,349 per month per spouse, asset limit is $3,000 ($128,640 for non-applicant), and required level of care is help with three activities of daily learning.

Medicaid Waivers/ Community And Home-Based Services

Single income limit is $2,349 per month, asset limit is $2,000, and required level of care is help with three activities of daily learning.

Married with one spouse applying limit is $2,349 per month, asset limit is $2,000 ($128,640 for non-applicant), and required level of care is help with three activities of daily learning.

Married with both spouses applying limit is $2,349 per month per spouse, asset limit is $3,000 ($128,640 for non-applicant), and required level of care is help with three activities of daily learning.

Medicaid/ Aged, Blind, And Disabled

Single income limit is $1,063 per month, asset limit is $2,000, and no level of care is required.

Married with one spouse applying limit is $1,437 per month, asset limit is $3,000, and no level of care is required.

Married with both spouses applying limit is is $1,437 per month, asset limit is $3,000, and no level of care is required.

Four Free Indiana Health Insurance Options

Hoosier Healthwise, HIP, Hoosier Care Connect, and Medicaid, are four free (or nearly free) Indiana health insurance options for low-income, elderly or special-needs residents. Each choice fills a specific need. For example, if you are currently pregnant, Hoosier Healthwise may be the best choice. (picture courtesy of in.gov)

The Care Select program ended four years ago. Hoosier Care Connect is its replacement, and is a care program for IHCP. Applicants that have reached age 65 and are not Medicare-eligible can often qualify. Information needed to enroll includes your name, date of birth, social security number, benefit and income details, and certain tax and family details. Many uncommon expenses are covered, including bariatric surgery (if medically necessary), diabetes strips, foot care, hearing aids, leg braces, and orthopedics shoes.

Special medical needs for the blind or disabled are sometimes best served by this program. Some of the specific conditions you must have for eligibility include depression, serious mental illness, heart and kidney disease, diabetes and congestive heart failure. Wards of the court and former and current foster children are often recipients of the available benefits. Behavioral, health, and social problems are discussed and treated.

If you are disabled, M.E.D. Works is an ideal solution. Under this program, you can try working again without putting your Medicaid eligibility at risk. For many years, this has been a major concern of many disabled Hoosiers attempting to return to the workforce. It is important to understand that M.E.D. benefits are “single only” since dependents and your wife/husband are not eligible. Also, your household income must be less than 350% of the Federal Poverty Level (FPL).

Health Exchange rates in Indiana are lower than anticipated. Although free medical coverage isn’t available for every adult and child, the new laws are certainly making it easier to purchase low-cost benefits.

PAST UPDATES:

The Indiana Family and Social Services Administration (FSSA) is continuing coverage for approximately 10,000 Hoosiers that were originally scheduled to lose benefits on December 31st. The extension will be for an additional four months and will provide extra time to enroll in a Marketplace plan. It’s expected that many of these persons will qualify for large federal subsidies that could reduce premiums by 10%-100%.

The FSSA had previously notified many current “Healthy Indiana” participants of the change. Most of these persons had household earnings that were too high to continue to qualify for the low-cost coverage. The guideline was based on 100% of the Federal Poverty Level guidelines. The cost of extending benefits will be paid out of the trust money accumulations.

“Right To Try” legislation is being considered that will help consumers that are terminally ill. Currently available in many other states, the legislation would allow certain patients to use existing drugs that are considered safe, but are not yet ready for national distribution.

Of course, positive results are not guaranteed and not all patients will be candidates. The Food And Drug Administration also hopes to shorten the process of approving medications that would also help anyone in this situation.

Indiana inmates may be getting free healthcare coverage thanks to House Bill 1269 which becomes active in September. Taxpayers may also benefit, since the inmates, by qualifying for Medicaid, will actually cost less to the state. HIP 2.0 enrollment will be assisted by the sheriff, who can also help if/when the inmate is released from the detention facility.

More than 200,000 Hoosiers have signed up for coverage so far (for 2016 effective dates). January 31st is the last day to enroll for a policy without an SEP exception. However, CHIP, Medicaid, and Medicare are available throughout the year, if you meet eligibility requirements.