Last Updated on by SiteControl

Indiana individual UnitedHealthcare health insurance (UHC) plans are a great choice if you are trying to find affordable medical coverage. We represent UHC and offer their policies at direct prices. Also known as “Golden Rule,” they feature contracts for a family, an individual, the self-employed, a business owner, or any person that is uninsured. Senior Medicare plans are available for persons that have reached age 65. AARP and UHC jointly offer several Medigap options in all Hoosier State counties. Medicare Advantage (MA) plans offer consumers several options that include ancillary benefits and more than 1.7 million physicians and 7,000 hospitals are available worldwide.

You can use benefits to bridge a short-term gap, or keep it for several years. Officially, UHC is licensed under the All Savers Insurance Company (ASIC) name for Marketplace (Exchange) plans. Mobile app capability is also offered for various wellness-related activities and expense-tracking. Ask us about it! Here in the Hoosier State, medical, dental, vision, Medicare, Medicaid, term life, hospital and physician, critical illness, disability, and international travel coverage is offered. As of 2026, Marketplace plans are available, and UHC is rapidly expanding in several states, including neighbor Ohio several years ago.

County And National Coverage

All counties are available in the UHC network including smaller Southwestern counties such as Posey, Gibson, Vanderburgh, and Warrick. Consumers can find a physician, hospital, medical facility, mental health clinician, dentist, vision care provider, Medicare physician, or Medicaid physician. DualComplete plan providers for Seniors can also be viewed. Emergency life-threatening situations are typically covered regardless where the US treatment occurs.Advantage plans can take advantage of a countrywide network of providers.

Although there are more than 500 local pharmacies available, an additional 30,000 pharmacies are available across the US if you are traveling. If you need access to out-of-state treatment, upon request, we will provide a comprehensive list of physicians, specialists and hospitals within 20 miles of your location. Mobile access is also provided, so you can find a doctor, speak to a nurse (24/7), get cost estimates for common procedures, show your ID card, and many additional tasks.

Catastrophic, comprehensive, short-term and Indiana HSA plans are featured on our website with many deductible and coverage options that will give you the opportunity to choose the perfect choice. Both on and off Marketplace policies are offered. Although a federal subsidy will be available (based on your household income), you are not required to purchase a subsidized plan. Regardless of your income, you may elect to enroll in a non-subsidized option. UHC does offer private (non-Group) under age-65 coverage in Indiana and many additional areas of the country.

Prior to Obamacare, many private single and family plans were available. Plans were medically-underwritten, and available in all areas. UHC offers Marketplace plans in 30 states for 2026, including border states Ohio and Illinois. Their rates are typically very competitive, and the nationwide PPO network is quite popular. The four newest states are Indiana, Iowa, Nebraska, and Wyoming. Last year, the four newest states were New Jersey, South Carolina, Wisconsin, and New Mexico. Claims and payment information can be found here.

NOTE: Temporary contracts can be issued for 1-36 months. The “Value” option is the least expensive plan since deductibles are considered “per incident.” Other plan options include “Copay,” “Plus,” “Plus Elite,” “Medical Copay,” “Medical Value,” and “Copay Value” policies. Plans can be easily customized to add enhanced office visit or prescription drug benefits. A wide range of deductibles and coinsurance is also offered. It is possible for a dependent to purchase a short-term plan while his/her parents are enrolled in a Marketplace contract. However, no federal subsidy or tax credit will be offered.

Short-Term Health Insurance Rates

Plans do not provide qualifying health coverage, since all required “essential benefits” are not included. Coverage can be issued for as long as 36 months. Before the end of the initial term, you can re-apply for an extra term. If additional coverage is needed (beyond 36 months), coverage is offered through additional unaffiliated companies. Shown below are monthly six-month policy rates in various counties for selected ages for the “Short Term Medical Value” and “Short Term Medical Plus” plans.

Marion, Hamilton, And Allen Counties Male Age 35 – Medical Value

$171 – $15,000 Deductible

$226 – $7,500 Deductible

$293 – $5,000 Deducible

$366 – $2,500 Deducible

Marion, Hamilton, And Allen Counties Male Age 35 – Medical Plus

$234 – $15,000 Deductible

$310 – $7,500 Deductible

$400 – $5,000 Deducible

$501 – $2,500 Deducible

Marion, Hamilton, and Allen Counties Male Age 45 – Medical Value

$255 – $15,000 Deductible

$337 – $7,500 Deductible

$437 – $5,000 Deducible

$536 – $2,500 Deducible

Marion, Hamilton, and Allen Counties Male Age 45 – Medical Plus

$349 – $15,000 Deductible

$461 – $7,500 Deductible

$597 – $5,000 Deducible

$746 – $2,500 Deducible

Marion, Hamilton, and Allen Counties Male Age 55 – Medical Value

$386 – $15,000 Deductible

$509 – $7,500 Deductible

$659 – $5,000 Deducible

$824 – $2,500 Deducible

Marion, Hamilton, and Allen Counties Male Age 55 – Medical Plus

$527 – $15,000 Deductible

$696 – $7,500 Deductible

$901 – $5,000 Deducible

$1,126 – $2,500 Deducible

Lake County Female Age 35

$89 – $15,000 Deducible

$114 – $7,500 Deducible

$145 – $5,000 Deducible

$178 – $2,500 Deducible

Lake County Female Age 45

$118 – $15,000 Deducible

$152 – $7,500 Deducible

$194 – $5,000 Deducible

$240 – $2,500 Deducible

Lake County Female Age 55

$153 – $15,000 Deducible

$199 – $7,500 Deducible

$255 – $5,000 Deductible

$316 – $2,500 Deducible

Indiana Marketplace Health Insurance Options Previously Offered

Bronze Tier

Compass HSA Bronze 6550 – HSA-eligible plan with $6,550 deductible and 0% coinsurance. One of UHC’s cheapest available plans.

Compass Bronze 7100 – $7,100 deductible but copays of $100 and $200 on primary care physician (pcp) and specialist office visits. $7,150 Maximum out-of-pocket expenses.

Silver Tier

Compass Silver 5200 – Very low $5 and $30 office visit copays. $5,200 deductible with $5 generic drug copay.

Compass HSA Silver 2800 – HSA-eligible plan with $2,800 deductible and $6,500 maximum out-of-pocket expenses. $25 and $50 office visit copays, but after deductible is met.

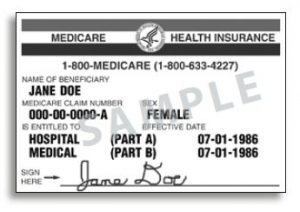

UnitedHealthcare Senior Products In Indiana

Medicare Supplement

Ten standardized plans are offered. Shown below are monthly rates for several scenarios. Policies are issued by AARP and insured by UHC.

65 Year-Old Residing Indianapolis (Marion County) plus Johnson, Carmel, Clinton, Madison, Shelby, Hendricks, Putnam, Rush, Noble, St. Joseph, Morgan, Henry, Howard, Lake, Lagrange, Miami, Gibson, Vigo, Sullivan, Parke, Clay, Vermillion, Vanderburgh, and Hancock Counties

Plan A – $79

Plan B – $114

Plan C – $145

Plan Select C – $116

Plan F – $145

Plan F (HD) – $116

Plan G – $124

Plan K – $50

Plan L – $82

Plan N – $101

70 Year-Old Residing Indianapolis (Marion County) plus Johnson, Carmel, Clinton, Madison, Shelby, Hendricks, Putnam, Rush, Noble, St. Joseph, Morgan, Henry, Howard, Lake, Lagrange, Miami, Gibson, Vigo, Sullivan, Park, Clay, Vermillion, Vanderburgh, and Hancock Counties

Plan A – $97

Plan B – $141

Plan C – $178

Plan Select C – $143

Plan F – $179

Plan F (HD) – $143

Plan G – $153

Plan K – $61

Plan L – $102

Plan N – $124

65 Year-Old Residing in Fort Wayne (Allen County)

Plan A – $78

Plan B – $114

Plan C – $145

Plan F – $145

Plan G – $124

Plan K – $49

Plan L – $82

Plan N – $100

70 Year-Old Residing in Fort Wayne (Allen County)

Plan A – $97

Plan B – $141

Plan C – $178

Plan F – $179

Plan G – $153

Plan K – $61

Plan L – $102

Plan N – $124

65 Year-Old Residing in Evansville (Vanderburgh County)

Plan A – $79

Plan B – $114

Plan C – $145

Plan F – $145

Plan G – $124

Plan K – $49

Plan L – $82

Plan N – $100

70 Year-Old Residing in Evansville (Vanderburgh County)

Plan A – $97

Plan B – $141

Plan C – $178

Plan F – $179

Plan G – $153

Plan K – $61

Plan L – $102

Plan N – $124

Medicare Advantage

Advantage contracts are issued by private insurers. Coverage is referred to as “Part C” or “MA Plans,” and is designed to offer an alternative to original benefits. Part A and Part B are included along with many other benefits. Five plans are offered by UnitedHealthcare.

AARP Medicare Advantage Essentials From UHC IN-12 (HMO-POS) – $440 deductible with $3,900 maximum out-of-pocket expenses. Office visit copays are $0 and $0-$35. A $0-$400 copay applies to outpatient hospital coverage. Diagnostic tests and procedures are subject to a $5 copay. Lab services and outpatient x-rays are covered with $0 and $5 copays respectively. Inpatient hospital copay is $400 for 4 days.

An annual eye exam is included along with dental exams and x-rays subject to a $0 copay. Hearing exams and routine foot care visits are subject to $0 and $35 copays respectively. Hearing aids are also covered with a copay. Prescription copays are $0 (Tier 1), $0 (Tier 2), 22% (Tier 3), and 44% (Tier 4). 90-day preferred mail order copays are $0 (Tier 1), $0 (Tier 2), 22% (Tier 3), and n/a (Tier 4).

AARP Medicare Advantage Extras From UHC IN-17 (HMO-POS) – $520 deductible with $6,700 maximum out-of-pocket expenses. Office visit copays are $0 and $0-$55. A $0-$525 copay applies to outpatient hospital coverage. Diagnostic tests and procedures are subject to a $5 copay. Lab services and outpatient x-rays are covered with $0 and $5 copays respectively. Inpatient hospital copay is $525 for 4 days.

An annual eye exam is included along with dental exams and x-rays subject to a $0 copay. Hearing exams and routine foot care visits are subject to $0 and $40 copays respectively. Hearing aids are also covered with a copay. Prescription copays are $0 (Tier 1), $0 (Tier 2), 21% (Tier 3), and 42% (Tier 4). 90-day preferred mail order copays are $0 (Tier 1), $0 (Tier 2), 21% (Tier 3), and n/a (Tier 4).

AARP Medicare Advantage From UHC IN-0002 (PPO) – $520 deductible with $3,900 maximum out-of-pocket expenses. Office visit copays are $0 and $0-$40. A $0-$425 copay applies to outpatient hospital coverage. Diagnostic tests and procedures are subject to a $5 copay. Lab services and outpatient x-rays are covered with $0 and $5 copays respectively. Inpatient hospital copay is $425 for 5 days.

An annual eye exam is included along with dental exams and x-rays subject to a $0 copay. Hearing exams and routine foot care visits are subject to $0 and $35 copays respectively. Hearing aids are also covered with a copay. Prescription copays are $0 (Tier 1), $0 (Tier 2), 21% (Tier 3), and 40% (Tier 4). 90-day preferred mail order copays are $0 (Tier 1), $0 (Tier 2), 21% (Tier 3), and n/a (Tier 4).

AARP Medicare Advantage From UHC IN-0007(PPO) – $0 deductible with $4,800 maximum out-of-pocket expenses. Office visit copays are $0 and $0-$40 with no referral required. A $0-$390 copay applies to outpatient hospital coverage. Diagnostic tests and procedures are subject to a $30 copay. Lab services and outpatient x-rays are covered with $0 and $30 copays respectively. The Urgent Care and ER copays are $0-$40 and $120. Inpatient hospital copay is $390 for 5 days.

An annual eye exam is included along with dental exams and x-rays subject to a $0 copay. Hearing exams and routine foot care visits are subject to $0 and $40 copays respectively. Hearing aids are also covered with a copay. Prescription copays are $0 (Tier 1), $10 (Tier 2), $45 (Tier 3), and $95 (Tier 4). 90-day preferred mail order copays are $0 (Tier 1), $0 (Tier 2), $125 (Tier 3), and $275 (Tier 4).

AARP Medicare Advantage Choice Plan 1 (PPO) – $0 deductible with $3,900 maximum out-of-pocket expenses. Office visit copays are $0 and $30 with no referral required. A $350 copay applies to outpatient hospital coverage. Diagnostic tests and procedures are subject to a $15 copay. Lab services and outpatient x-rays are covered with $5 and $14 copays respectively. The Urgent Care and ER copays are $40 and $90. Inpatient hospital copay is $370 for 5 days.

An annual eye exam is included along with dental exams and x-rays subject to a $0 copay. Hearing exams and routine foot care visits are subject to $0 and $30 copays respectively. Hearing aids are also covered with a copay. Prescription copays are $0 (Tier 1), $8 (Tier 2), $45 (Tier 3), and $95 (Tier 4). 90-day preferred mail order copays are $0 (Tier 1), $0 (Tier 2), $125 (Tier 3), and $275 (Tier 4).

AARP MedicareComplete Profile HMO – $225 deductible with $4,500 maximum out-of-pocket expenses. Office visit copays are $5 and $40 with no referral required. A $245 copay applies to outpatient hospital coverage. Diagnostic tests and procedures are subject to a $15 copay. Lab services and outpatient x-rays are covered with $3 and $14 copays respectively. The Urgent Care and ER copays are $30/$40 and $90.

An annual eye exam is included along with dental exams and x-rays subject to a $0 copay. Hearing exams and routine foot care visits are subject to $5 and $40 copays respectively. Hearing aids are also covered with a copay. Prescription copays are $3 (Tier 1), $12 (Tier 2), $47 (Tier 3), and $100 (Tier 4). 90-day preferred mail order copays are $0 (Tier 1), $0 (Tier 2), $125 (Tier 3), and $275 (Tier 4).

AARP MedicareComplete Focus PPO – $210 deductible with $4,800 maximum out-of-pocket expenses. Office visit copays are $5 and $40 with no referral required. A $360 copay applies to outpatient hospital coverage. Diagnostic tests and procedures are subject to a $0 copay. Lab services and outpatient x-rays are covered with $2 and $14 copays respectively. The Urgent Care and ER copays are $30/$40 and $90.

An annual eye exam is included along with dental exams and x-rays subject to a $0 copay. Hearing exams and routine foot care visits are subject to $5 and $40 copays respectively. Hearing aids are also covered with a copay. Prescription copays are $2 (Tier 1), $8 (Tier 2), $45 (Tier 3), and $95 (Tier 4). 90-day preferred mail order copays are $0 (Tier 1), $0 (Tier 2), $125 (Tier 3), and $275 (Tier 4).

Medicare Prescription Drug Plans

Prescription drug coverage (Part D) is available during your initial enrollment period (IEP). this time period is generally the best time to secure coverage, since you are immediately eligible, and any current medications do not impact the price of the policy. Otherwise, Medicare plans can be purchased during the regular Open Enrollment period. The “Catastrophic Coverage Stage” is effective after $5,000 is reached.

When this occurs, you pay the following: $3.35 for generic drugs, $8.35 for brand name drugs, or a 5% coinsurance (whichever is higher). If the “Coverage Gap Stage” occurs, no more than 44% of the cost of generic drugs, or 35% of the cost of brand name drugs, until $5,000 of out-of-pocket expenses has been reached.

The following are available options and costs in Indiana:

AARP MedicareRx Walgreens – $28.20 per month. $350 deductible.13,975 members statewide. Available drugs are 54 (Tier 1), 537 (Tier 2), and 1,041 (Tier 3). 30-day preferred pharmacy copays are $1 (Tier 1), $10 (Tier 2), $40 (Tier 3), 45% (Tier 4), and 27% (Tier 5). 90-day preferred pharmacy copays are $3 (Tier 1), $30 (Tier 2), $120 (Tier 3), 45% (Tier 4), and n/a (Tier 5). 3.0 Star Plan Summary Rating.

AARP MedicareRx Preferred – $102.20 per month. $0 deductible. 35,233 members statewide. Available drugs are 157 (Tier 1), 725 (Tier 2), and 980 (Tier 3). 30-day preferred pharmacy copays are $7 (Tier 1), $12 (Tier 2), $47 (Tier 3), 40% (Tier 4), and 33% (Tier 5). 90-day preferred pharmacy copays are $21 (Tier 1), $60 (Tier 2), $141 (Tier 3), 40% (Tier 4), and n/a (Tier 5). 3.5 Star Plan Summary Rating.

AARP MedicareRx Saver Plus – $29.30 per month. $505 deductible. 20,387 members statewide. Available drugs are 54 (Tier 1), 798 (Tier 2), and 732 (Tier 3). 30-day preferred pharmacy copays are $1 (Tier 1), $6 (Tier 2), 18% (Tier 3), 42% (Tier 4), and 25% (Tier 5). 90-day preferred pharmacy copays are $3 (Tier 1), $18 (Tier 2), 18% (Tier 3), 42% (Tier 4), and n/a (Tier 5). 3.0 Star Plan Summary Rating. Medicare and Medicaid options are offered.

Hospital And Doctor Fixed Indemnity Plan Benefits

WORx (Wellness, office visits, and prescription drugs) provides flexible and customized options.

WORx 1 – $80 per wellness exam, $25 per health screening diagnostic labs, $100 per mammogram (females 30 and over), and $300 for a colonoscopy. Additional benefits include $80 for doctor’s visits, $100 for specialist visits and Urgent Care visits, and $200 for office visits with in-office surgery. Name brand and generic prescription refills are $40 and $10.

WORx 2 – $100 per wellness exam, $50 per health screening diagnostic labs, $50 health screening x-ray, $150 per mammogram (females 30 and over), and $300 for a colonoscopy. Additional benefits include $100 for doctor’s visits, $125 for specialist visits and Urgent Care visits, and $225 for office visits with in-office surgery. Name brand and generic prescription refills are $60 and $10.

WORx 3 – $125 per wellness exam, $100 per health screening diagnostic labs, $100 health screening x-ray, $150 per mammogram (females 30 and over), and $500 for a colonoscopy. Additional benefits include $125 for doctor’s visits, $150 for specialist visits and Urgent Care visits, and $250 for office visits with in-office surgery. Name brand and generic prescription refills are $60 and $20.

Simple fixed indemnity benefit coverage can be renewed to age 65. They are designed to help pay out-of-pocket expenses associated with high-deductible medical plans. They are not designed to provide comprehensive coverage, but instead provide a stated level of coverage, regardless of the actual healthcare expenses. “HealthiestYou” by Teladoc is included on all products. The following plans (underwritten by Golden Rule) were previously available:

Health ProtectorGuard Plan A – Benefits include $50 per day office visit and Urgent Care for a maximum of four times per year. Generic prescriptions of $10 per day with a $750 calendar year maximum. Brand prescription drugs of $25 per day with a $750 calendar year maximum. Outpatient lab and x-rays – $25 and $50 per day respectively with $500 annual maximum. Outpatient diagnostic imaging services – $75 per day with $500 calendar year maximum.

Inpatient hospital confinement is $500 per day up to 180 days per calendar year. Intensive care pays $500 per day with a 30 day per year calendar maximum. ER pays $200 per day one time per calendar year. Surgical schedule daily benefits include $2,000 for inpatient surgery, $1,000 for outpatient surgery, $200 for anesthesia, and $200 physician’s office surgery (maximum two per year). Air and ground ambulance reimbursements are $500 and $100 respectively.

Health ProtectorGuard Plan B – Benefits include $50 per day office visit and Urgent Care for a maximum of four times per year. Generic prescriptions of $10 per day with a $750 calendar year maximum. Brand prescription drugs of $25 per day with a $750 calendar year maximum. Outpatient lab and x-rays – $25 and $50 per day respectively with $500 annual maximum. Outpatient diagnostic imaging services – $75 per day with $500 calendar year maximum.

Inpatient hospital confinement is $1,000 per day up to 180 days per calendar year. Intensive care pays $1,000 per day with a 30 day per year calendar maximum. ER pays $200 per day one time per calendar year. Surgical schedule daily benefits include $2,000 for inpatient surgery, $1,000 for outpatient surgery, $200 for anesthesia, and $200 physician’s office surgery (maximum two per year). Air and ground ambulance reimbursements are $500 and $100 respectively. Plan B costs slightly more than Plan A.

Health ProtectorGuard Plan C – Benefits include $50 per day office visit and Urgent Care for a maximum of four times per year. Generic prescriptions of $10 per day with a $750 calendar year maximum. Brand prescription drugs of $25 per day with a $750 calendar year maximum. Outpatient lab and x-rays – $25 and $50 per day respectively with $500 annual maximum. Outpatient diagnostic imaging services – $75 per day with $500 calendar year maximum.

Inpatient hospital confinement is $2,000 per day up to 180 days per calendar year. Intensive care pays $2,000 per day with a 30 day per year calendar maximum. ER pays $200 per day one time per calendar year. Surgical schedule daily benefits include $2,000 for inpatient surgery, $1,000 for outpatient surgery, $200 for anesthesia, and $200 physician’s office surgery (maximum two per year). Air and ground ambulance reimbursements are $500 and $100 respectively. Plan C costs slightly more than Plan B.

Core Access Value Plan 1 – Deductible options of $0, $1,000, $2,500, and $5,000. Inpatient hospital confinement coverage of $1,000, and $2,000 for intensive care or critical care unit. Inpatient hospital physician visits receive $50 reimbursement. Maximum inpatient surgical service is $2,250 per surgery ($1,500 -primary surgeon, $300 – assistant surgeon, and $450 anesthesiologist). Maximum total benefit for outpatient surgical service is $1,950 ($600 – facility, $900 – surgeon, $180 – assistant surgeon, and $270 anesthesiologist).

Maximum ambulance service coverage per trip per year is $100 (ground or water) and $500 (air). Second surgical opinion benefit is $100 and $300 for outpatient chemotherapy and radiation. Outpatient prescription drugs and maternity expenses are not covered. $200 of preventative and wellness is included along with $60 (four times per year) for outpatient physician visits and retail health clinic visits. Outpatient Urgent Care and ER visits have a combined yearly coverage of $100. Outpatient diagnostic x-ray and lab fees covered up to $100 per year while outpatient advanced studies covered up to $200 per year.

Core Access Value Plan 2 – Deductible options of $0, $1,000, $2,500, and $5,000. Inpatient hospital confinement coverage of $1,500, and $2,500 for intensive care or critical care unit. Inpatient hospital physician visits receive $60 reimbursement. Maximum inpatient surgical service is $3,000 per surgery ($2,000 -primary surgeon, $400 – assistant surgeon, and $600 anesthesiologist). Maximum total benefit for outpatient surgical service is $2,200 ($700 – facility, $1,000 – surgeon, $200 – assistant surgeon, and $300 anesthesiologist).

Maximum ambulance service coverage per trip per year is $300 (ground or water) and $1,000 (air). Second surgical opinion benefit is $100 and $600 for outpatient chemotherapy and radiation. Outpatient prescriptions are covered with $4, $20, and $50 copays on generic, name brand and specialty drugs respectively. Maternity coverage is $3,000 per year. $200 of preventative and wellness is included along with $60 (four times per year) for outpatient physician visits and retail health clinic visits. Outpatient Urgent Care and ER visits have a combined yearly coverage of $100. Outpatient diagnostic x-ray and lab fees covered up to $100 per year while outpatient advanced studies covered up to $300 per year.

Core Access Premier Plan 1 – Deductible options of $0, $1,000, $2,500, and $5,000. Inpatient hospital confinement coverage of $2,000, and $3,000 for intensive care or critical care unit. Inpatient hospital physician visits receive $70 reimbursement. Maximum inpatient surgical service is $6,000 per surgery ($4,000 -primary surgeon, $800 – assistant surgeon, and $1,200 anesthesiologist). Maximum total benefit for outpatient surgical service is $2,600 ($800 – facility, $1,200 – surgeon, $240 – assistant surgeon, and $360 anesthesiologist).

Maximum ambulance service coverage per trip per year is $400 (ground or water) and $1,500 (air). Second surgical opinion benefit is $100 and $800 for outpatient chemotherapy and radiation. Outpatient prescriptions are discounted. Maternity coverage is not included. $200 of preventative and wellness is included along with $60 (four times per year) for outpatient physician visits and retail health clinic visits. Outpatient Urgent Care and ER visits have a combined yearly coverage of $200. Outpatient diagnostic x-ray and lab fees covered up to $100 per year while outpatient advanced studies covered up to $500 per year.

Core Access Premier Plan 2 – Deductible options of $0, $1,000, $2,500, and $5,000. Inpatient hospital confinement coverage of $3,000, and $4,500 for intensive care or critical care unit. Inpatient hospital physician visits receive $80 reimbursement. Maximum inpatient surgical service is $9,000 per surgery ($6,000 -primary surgeon, $1,200 – assistant surgeon, and $1,800 anesthesiologist). Maximum total benefit for outpatient surgical service is $3,900 ($1,200 – facility, $1,800 – surgeon, $360 – assistant surgeon, and $540 anesthesiologist).

Maximum ambulance service coverage per trip per year is $500 (ground or water) and $2,000 (air). Second surgical opinion benefit is $100 and $1,000 for outpatient chemotherapy and radiation. Outpatient prescriptions are covered with $4, $20, and $50 copays on generic, name brand and specialty drugs respectively. Maternity coverage is $5,000 per year. $200 of preventative and wellness is included along with $60 (four times per year) for outpatient physician visits and retail health clinic visits. Outpatient Urgent Care and ER visits have a combined yearly coverage of $300. Outpatient diagnostic x-ray and lab fees covered up to $100 per year while outpatient advanced studies covered up to $700 per year.

Supplemental Indemnity Plans

Benefits are provided in specific per-determined amounts for in-hospital expenses.

Hospital SafeGuard Plan A – $1,000 per day benefit (31 days) for inpatient hospital confinement. Additional $1,000 per day benefit for 10 days.

Hospital SafeGuard Plan B – $2,000 per day benefit (7 days) for inpatient hospital confinement. Additional $2,000 per day benefit for 7 days.

Hospital SafeGuard Premier Plan A – $500 per day benefit (31 days) for inpatient hospital confinement. Additional $500 per day benefit for 10 days. $500 for each air ambulance transport and $100 for each ground ambulance transport (limit of two for both). $50 for one Urgent Care visit and $100, $500, and $1,000 for physician office, outpatient, and inpatient surgery (two surgery limit).

Hospital SafeGuard Premier Plan B – $1,000 per day benefit (31 days) for inpatient hospital confinement. Additional $1,000 per day benefit for 10 days. $500 for each air ambulance transport and $100 for each ground ambulance transport (limit of two for both). $50 for one Urgent Care visit and $100, $500, and $1,000 for physician office, outpatient, and inpatient surgery (two surgery limit).

Single And Family UHC Dental Plans

UnitedHealthcare offers several dental options in Indiana (see below).

Dental Primary -Offers immediate coverage and provider network discounts for basic and preventative services. Basic services pay 50% once policy is effective, 65% after one year and 80% after two years. Major services (root canals, bridges, oral surgery, and crowns) not covered. $1,000 annual maximum benefit. $50 policy deductible.

Dental Primary Plus -Offers immediate coverage and provider network discounts for basic and preventative services, and additional non-network coverage. Basic services pay 50% once policy is effective, 65% after one year and 80% after two years. Major services (root canals, bridges, oral surgery, and crowns) not covered. $1,000 annual maximum benefit. $50 policy deductible.

Dental Primary Preferred -Major services covered after six months. Basic services pay 35% once policy is effective, 65% after one year and 80% after two years. Preventative services covered at 100%. Major services (root canals, bridges, oral surgery, and crowns) are covered. $1,000 annual maximum benefit. $50 policy deductible.

Dental Primary Preferred Plus – This plan allows you to use any dentist, and major services are covered after six months. Basic services pay 35% once policy is effective, 65% after one year and 80% after two years. Preventative services covered at 100%. Major services (root canals, bridges, oral surgery, and crowns) are covered. $1,000 annual maximum benefit. $50 policy deductible.

UHC Private Vision Benefits

Customized plans with no waiting period are available. By utilizing a network provider, a copay will cover exams and/or lenses. An allowance is provided for glasses. Non-network benefits are also provided, but out-of-pocket expenses are higher. Providers can offer full service, lenses and glasses only, at discounted rates, or exams (only) at discounted rates. The primary insured must be at least 18 years old. Two plans are available:

Plan A – One annual eye exam is provided with a $10 copay. A $50 allowance is provided for non-network providers. A $150 allowance is provided for frames (network providers). Non-network providers receive a $75 allowance. A $10 copay applies to the annual purchase of lenses. If non-network, the following allowances are provided: $40 – single vision, $60 – bifocal, and $80 – trifocal. Select and medically-necessary contact lenses have a $0 copay. Non-selection contacts receive a $125 allowance.

Plan B – One annual eye exam is provided with a $10 copay. A $50 allowance is provided for non-network providers. A $150 allowance is provided for frames (network providers). Non-network providers receive a $75 allowance. A $10 copay applies to the annual purchase of lenses. If non-network, the following allowances are provided: $40 – single vision, $60 – bifocal, and $80 – trifocal. In addition to glasses, select and medically-necessary contact lenses have a $0 copay. Non-selection contacts receive a $150 allowance.

Critical Illness Plans

Critical illness plans provide limited benefits for specific types of medical conditions. These types of policies are designed to supplement existing coverage, but not act as a primary plan. Cash is paid directly to the applicant for covered illnesses. Generally, money is paid upon the initial diagnosis, and not on a specific amount of expenses. Coverage between $10,000 and $50,000 is available. The diagnosis must be made 30 days after the effective date of coverage. Benefits are renewable to age 70. Applicants must be between the ages of 18 and 59.

Critical illness conditions: Heart attack, stroke, cancer (life-threatening), coma, renal kidney failure, major transplant, paralysis, non-invasive cancer, loss of hearing, vision, or speech, and coronary artery bypass graft.

Estimated current monthly rates below are for males. Female rates are slightly lower. Amounts shown are maximum benefits payable per policy.

40 Year-Old Rates

$10,000 – $16.67

$20,000 – $33.33

$30,000 – $50.00

$40,000 – $66.67

$50,000 – $83.33

50 Year-Old Rates

$10,000 – $35.33

$20,000 – $70.67

$30,000 – $106.00

$40,000 – $141.33

$50,000 – $176.67

55 Year-Old Rates

$10,000 – $45.08

$20,000 – $90.17

$30,000 – $135.25

$40,000 – $180.33

$50,000 – $225.42

Accident Plans

Limited accidental benefits are provided by four available options (see below). These types of policies are not considered major medical or comprehensive coverage, and are not designed to act as primary stand-alone plans. They are not eligible for federal subsidies and do not meet standard mandatory healthcare guidelines. Accidental injuries include lacerations, fractures, burns, concussion, and dislocation. A complete list of covered expenses is provided with the policy, and also available upon request.

All applicants must be between the ages of 18 and 64. Coverage is renewable until age 65. Proof of a covered loss must be submitted within 90 days to receive benefits. Naturally, injuries resulting from an accident that occurred before the effective date of the policy, are not covered. A basic review of the four available plans is listed below:

SafeGuard Plan A – $16 estimated monthly rate. $75 paid for first physician’s office visit and Urgent Care visit. $35 is paid for a maximum of 6 follow-up visits that occur within 30 days of accident or discharge. $150 paid for Diagnostic (MRI, EKG, or CT). $125 paid for hospital ER visit. $200 paid for ground ambulance ($1,000 air). $25,000 of accidental death coverage.

$1,000 is paid for intensive care admissions, $200 per day is paid for hospital confinement (up to 365 days), and $400 per day for ICU confinement (up to 15 days). The rehab facility confinement is $100 (30 consecutive days or 60 days for multiple dates throughout the year.). Surgical services benefits vary from $250 – $1,000 for treatment within 12 months of accident.

SafeGuard Plan B – $22 estimated monthly rate. $100 paid for first physician’s office visit and Urgent Care visit. $50 is paid for a maximum of 8 follow-up visits that occur within 30 days of accident or discharge. $200 paid for Diagnostic (MRI, EKG, or CT). $150 paid for hospital ER visit. $250 paid for ground ambulance ($1,500 air). $50,000 of accidental death coverage.

$1,500 is paid for intensive care admissions, $250 per day is paid for hospital confinement (up to 365 days), and $500 per day for ICU confinement (up to 15 days). The rehab facility confinement is $150 (30 consecutive days or 60 days for multiple dates throughout the year.). Surgical services benefits vary from $400 – $1,500 for treatment within 12 months of accident.

SafeGuard Plan C – $32 estimated monthly rate. $150 paid for first physician’s office visit and Urgent Care visit. $65 is paid for a maximum of 10 follow-up visits that occur within 30 days of accident or discharge. $250 paid for Diagnostic (MRI, EKG, or CT). $200 paid for hospital ER visit. $250 paid for ground ambulance ($1,500 air). $100,000 of accidental death coverage.

$2,000 is paid for intensive care admissions, $300 per day is paid for hospital confinement (up to 365 days), and $600 per day for ICU confinement (up to 15 days). The rehab facility confinement is $250 (30 consecutive days or 60 days for multiple dates throughout the year.). Surgical services benefits vary from $550 – $2,000 for treatment within 12 months of accident.

UnitedHealth Allies Discount Card

UHC offers a discount program that can save 10%-50% off your healthcare expenses. The coverage is NOT considered qualified health insurance, although you are able to receive substantial discounts on hundreds of products and services from online and retail providers. No forms are needed, and spouses and dependents can be included on the policy. Average savings are 5%-20% for hospital and outpatient surgery, 15%-35% for physician and specialist office visits, and 5%-35% for urgent care, physical therapy, diagnostic tests, and other similar expenses.

Participating drug stores include Albertsons, Cotsco, CVS, Eckerd Drugs, Kroger, Marsh, Meijer, Rite-Aid, Safeway, Sam’s Club, Target, Walgreens, and Walmart. More than 50,000 drug stores and grocery stores participate in the nationwide program. The typical savings is about 20%. Health Allies administers this program. Mail-order pharmacy options will likely reduce your out-of-pocket costs.

Telemed

“HealthiestYou” is an app (not an insurance product) that provides an online meeting (consultation) with a licensed physician. Services are available 24/7, and the monthly cost of the service is approximately $20. Prescription drugs can be prescribed along with additional treatment (if needed) from other professionals. Common consultation topics include urinary tract infection, sore throat, earache, allergies, bronchitis, pink eye, and respiratory infection. Through the app, members can search for providers, compare costs of procedures, and save money on prescriptions.

Private Plans No Longer Available

IMPORTANT: The plans listed below are no longer offered as new policies. However, if you currently are covered under of of these “grandfathered” plans, you may continue to keep them active, unless you receive a termination notice from UHC. If that occurs, you have approximately 60 days to choose another option and a subsidy would be provided if you meet eligibility guidelines.

Saver 80 If your primary concern is paying for catastrophic claims, then this policy may be the perfect solution. Most major medical expenses are covered including inpatient and outpatient surgical procedures, hospital confinements and many outpatient expenses such as MRIs and CAT scans. Preventive benefits are also included and covered at 100% with no waiting period or deductible. It is one of the least expensive private policies available in the state.

One of the recent changes to the policy was the addition of a “vanishing deductible” feature that automatically reduces your deductible each year it is not fully met (50% maximum). Thus, it is likely that you will start out with a lower deductible each year without requesting it. If you did submit an expensive claim, your good health in previous years can often save you thousands of dollars.

HSA 100 This policy is one of the premier Indiana Health Savings Account plans. An HSA is a combination of a tax-favored savings account with a high-deductible medical insurance plan (HDHP). Rates are typically substantially lower than comprehensive plans and your contributions into the HSA are tax-deductible. The “savings portion” is optional and many consumers choose not to activate that feature and just “keep it simple.”

Also, qualified future medical, dental and vision expenses are deductible and any money not spent in the current year will “roll” to the following year. You may choose your own bank to handle the savings account and you retain full control of your accumulated money at all times. At any time, you may withdraw unused funds from your account. It’s much different than many years ago when you risked losing your deposits if you did not spend them quickly enough.

Wellness and preventive care benefits are provided and are also included at 100% with no waiting period or deductible. And “network repricing” will reduce your out-of-pocket costs for claims that are subject to a deductible. We especially like HSAs because of the potential savings in premiums that you can use, and not the insurance carrier. You own and operate your personal coverage instead of someone else.

Copay Select One of the most comprehensive Indiana insurance plans is the “Copay Select” plan. With unlimited covered office visit benefits, this policy closely resembles an employer-provided plan. After a $35 copay, 100% of office visit history and exam fees are covered. An optional $25 copay is also available. If family members rarely go to the doctor, this would not be a good choice.

A prescription drug card covers four tiers of drugs with copays or coinsurance. Generic drugs are not subject to a deductible. Many additional riders are also available such as a $25 copay (instead of $35), a $50,000 accidental death benefit and term life insurance options. To keep premiums low, higher deductibles are available. We like the $2,500 and $5,000 options although a $10,000 deductible is also available. This is a PPO plan, as is the “Value” plan listed below.

Copay Select Value A more affordable version of the “Copay Select,” this plan provides benefits for four office visits per person per year (subject to a $35 copay). Generic prescription benefits are provided with a $15 copay. Non-generic RX is not covered. Although preventive benefits are covered, the, coinsurance on major claims is 30% after the deductible (instead of the standard 20%). Typically, premiums are about 25% less than the “Copay Select” plan, so it is an interesting option to consider.

If you would like to see more complete details on any of the policies described, or additional plans not mentioned, simply contact us.