Last Updated on by SiteControl

Affordable private Indiana medical insurance policies provide quality healthcare to individuals, families and small businesses that pay their own premiums. Fortunately, there are many attractive options that can give you generous benefits at a rate that is within your budget. We find these plans and make it easy for you to choose and enroll for coverage. Rates in the Hoosier state are often much lower than consumers realize.

Comprehensive copay plans with no deductibles on office visits are available in all counties. Typically, Urgent Care visits are subject to a copay without a requirement to meet a policy deductible or coinsurance. Silver-Tier plans with cost-sharing often provide a combination of the lowest offered office visit copays and policy deductibles. Specialist visit copays are typically larger than pcp visit copays.

Keep Premiums Low With Higher Deductibles

One of the best methods to keep premiums within your budget, and still maintain high quality coverage, is to purchase a plan with a higher deductible on the catastrophic expenses. This allows you to continue to pay low amounts ($15-50 on average) for most office visits and prescriptions, while keeping premiums manageable. And whether you have 2 or 20 covered office visits in a year, you may be able to avoid having to meet deductible for the most common items.

The Anthem Blue Cross And Blue Shield Heart Healthy Bronze Essential 4500 plan is one of the most popular low-cost comprehensive options in Indiana. Office visits are not subject to a deductible or coinsurance. The copays are $50 for primary care physician visits and $100 for specialist office visits. Generic and preferred brand drugs are subject to 55% coinsurance. The Urgent Care copay is $75 and ER visits have a $500 copay (plus coinsurance).

Since the Anthem plan is a “Marketplace” option, the federal subsidy will reduce your premium, depending on the number of members in your household and the total income. The more dependents that you declare on your federal tax return, the higher the subsidy will be.Your projected household income for the current or upcoming year greatly determines the amount of the instant tax credit.

Although the deductible is moderately high ($4,500), preventive benefits are covered with no waiting period or out-of-pocket costs. Also, the 10 mandatory “essential benefits” are included, making this plan one of the cheapest comprehensive policies offered to consumers. Coinsurance is 50%-55%, which is higher than the typical 0%-40%.

Deductibles apply to most items, but large network-negotiated discounts will reduce your out-of-pocket expenses. The most savings are realized with x-rays, lab tests, pcp office visits, and MRIs. Emergency life-threatening treatment always receives network cost reductions, regardless of the provider.

Previously-Available Anthem Exchange Plan

Another “must consider” policy was the Anthem Silver Pathway X 4250 30 plan. Because it was a “Silver” Medal plan, it was eligible for “cost-sharing,” which saved thousands of dollars in deductibles, coinsurance and copays.

Although the deductible was $4,250, based on the highest levels of subsidies, the amount could potentially reduce to $200. Also, the primary-care physician copay reduced from $25 to $15. Prescription copays reduced, making this plan one of the best Exchange choices if your Federal Poverty Level income was at the 138%-150% level. Just as importantly, specialist visits were not subject to a deductible.

Many additional economical plans are not available, since multiple companies no longer offer private coverage in the state. Aetna, Humana, and UnitedHealthcare (three of the largest US healthcare companies) have ceased offering Marketplace policies in the Hoosier State, although they offer Senior Medicare, Medicaid, and Group plans.

Short-Term Solutions

Temporary medical plans are the most affordable types of health care policies. Many companies, including UnitedHealthcare, HCC Life, IHC Group, Companion Life, and Allstate offer contracts that have a combination of cheap rates, simple applications, quick approvals, and comprehensive major medical coverage. Minimum benefits are required to be $2 million.

Although you typically can only purchase a policy for a year’s worth of coverage (or less), and pre-existing conditions are not honored, it may provide a “quick fix” if you are without coverage or transitioning from one job to another. A graduating student may also want to consider this type of policy, if waiting for new benefits to begin.Pivot Health offers a wide variety of contracts for persons under age 65.

If you miss Open Enrollment, temporary coverage is often the best of the available non-Marketplace plan options, since approval is quick, and catastrophic and major medical losses are mostly covered. But prescription, therapy, and out-of-area health benefits may be substantially reduced. Chronic illnesses may result in large out-of-pocket expenses, and cosmetic surgery generally benefits are generally excluded.

Limitations Of Temporary Plans

Exclusions on temporary contracts for prior conditions can create large out-of-pocket expenses. These policies are not designed to comply with ACA legislation and therefore do not include many benefits found in more expensive policies.

For example, maternity, mental illness, treatment for substance abuse and alcoholism, organ transplants, spinal manipulation, occupational and speech therapy, and pain medication are generally excluded. Also, limitations and higher coinsurance and copays are common features. However, Urgent Care visits are often covered with a copay, to discourage unneeded emergency room visits. Common copays are $50 and $75.

Note: One of our favorite low-cost plans before the Exchanges was UnitedHealthcare’s “Saver 80” policy. It was cheap, simple to understand, and if your application was approved, coverage began after 15 days. It was a classic “catastrophic” policy that was very popular for healthy households with incomes above $50,000. UHC returned to the Indiana Marketplace in 2025. US Health & Life exited the state and also several other states.

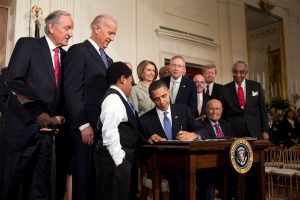

Impact Of ACA Legislation

The “Affordable Health Care Act” requires all policies to provide unlimited lifetime covered benefits. This change made the Saver 80 plan obsolete and it was never offered again. However, previously, as a grandfathered plan, many existing customers kept the policy for several years. It’s also possible that you were asked to switch to a more “compliant” plan that included the required Obamacare benefits.

Last year (see chart below), a record number of applicants enrolled in Exchange plans (more than 290,000). This was a record high after a dip in 2021.

What Happens If Your Health Changes?

When you purchase a policy, of course, your health may change at any time. Maybe in a few years. Maybe in 15 years. But regardless of the seriousness of your medical conditions, your insurer can not cancel you because your health changed. For example, if you develop an illness such as cancer or heart disease, and incur $1 million of medical bills in a calendar year (extremely unlikely), your personal policy must be renewed without interruption.

If the provider stops offering policies in Indiana or files for bankruptcy, that would be a different situation that would allow you to go through Open Enrollment and select a different plan. Many Co-Ops across the country have been failing, and policyholders are forced to secure alternative coverage. Christian Ministry plans have become more popular, but the payment of medical expenses is not guaranteed.

Review

Affordable insurance in Indiana can be found. Our website provides you with free quotes from the top companies, and we are confident you will find the perfect plan for yourself and any other family needs. After you compare different policies, if you wish to apply for benefits, the process is very simple and typically, no other medical information is required. Each year, we review your existing policy, and compare it to all other available options.