Last Updated on by SiteControl

Find affordable Medigap coverage in Indiana from top-rated companies. Instantly compare quality Medicare Supplement plans at the lowest available rates. We specialize in researching and reviewing Senior health insurance options here in the Hoosier State. Federal and state laws regulate 2026 prices and availability of policies, and each year, new plans can be introduced and prices can change.

Our free online quotes are available without any cost or obligation. You can easily view customized policies that fit within your budget and cover your individual and family medical expenses with the most cost-effective options. Deductibles, copays, and many services not paid by original Medicare, can be covered with the proper policy. MA plans utilize a provider network while “Supplement” plans typically allow you to choose any doctor, specialist, or hospital as long as they are enrolled in Medicare and accepting new patients.

“Advantage” contracts, which replace original Medicare, are also available with and without drug prescription benefits. Premiums are generally lower than other Medigap options, and often, additional benefits (fitness club memberships, dental benefits, and vision benefits) are included. Separate Part D prescription drug plans are also offered by many carriers, with several deductible, copay, and out-of-pocket options. Plan G (HD) contracts offer a single deductible and very competitive premiums compared to other Plan options.

Carriers publish their formulary drug list and consumers are encouraged to review all tiers. The description of tiers is listed below:

Tier 1 – Preferred, low-cost generic drugs

Tier 2 – Non-preferred and low-cost generic drugs

Tier 3 – Preferred brand name and expensive generic drugs

Tier 4 – Non-preferred brand name drugs and expensive generic drugs

Tier 5 – Specialty drugs and the most expensive medications

Open Enrollment

During Open Enrollment, your acceptance is guaranteed, and any plan can be chosen. This time period starts the first day of the month that you have reached age 65 and are also enrolled in Medicare Part B. You must meet both criteria. Your guarantee period lasts for six months. A separate 2026 Fall Enrollment began on October 15th and continued through December 7th. During this period, you can replace existing coverage or enroll in a new plan without answering medical questions.You may also retain an existing plan.

The under age 65 OE period begins on November 1 and ends on January 15. Marketplace plans are offered on all counties from CareSource and/or Ambetter. Although Bronze-tier plans are the most popular choice, Silver-Tier plans are most cost-effective for households that qualify for a federal subsidy. Catastrophic plans are provided for applicants under age 30, and often include three pcp office visits with a copay. However, specialist office visits are generally subject to the policy deductible.

There are also “Special Enrollment” periods that allow you to qualify for benefits at any time throughout the year. For example, if you move to a different state, move back to the US, or lose existing qualified coverage, you are provided 60 days to enroll in a new plan. More than 1 million persons in the state are covered and there’s room for you too! Any existing or past health conditions do not impact the premium or the effective date. Enrolling in COBRA may void eligibility for an SEP exception.

Medicare pays for most of your medical expenses. But there are many gaps in coverage that can become costly if you have to pay them. A Supplement (Medigap) policy will help pay those expenses so you’re not forced to pay large unexpected bills. There are many low-cost options that are budget-friendly, and quickly pay specified covered costs. Each year, you may also change plans to better match your projected medical expenses. Plan G (HD) is the least expensive option for new enrollees, and is available in all counties (see below).

High-Deductible Options

Cheaper high-deductible options are provided for individuals that don’t anticipate many medical expenses throughout the year. Although the cost is lower than other plans, many expenses must be paid out-of-pocket, including Part A coinsurance and hospital costs, Part B coinsurance or copayments, Part A deductible, and Parts A and B excess charges.

A high-deductible Plan G is inexpensive and popular for applicants that prefer to pay the lowest possible rate. The 2026 deductible is slightly higher than $2,800, and 100% benefit coverage begins after the deductible has been met. Its cost-sharing features allow you to obtain quality benefits at a rate lower than all other Supplement contracts. However, this type of plan is not suitable for all applicants. Plan G is also only available to new persons applying for coverage.

Plan F, however, is only offered to persons that are not new to Medicare. For persons that reached age 65 on January 1, three years ago, or after that date, Plan G (HD) became available. This also applies to applicants that initially become eligible for Medicare as a result of ESRD, age, or disability on or after January 1.

When You Retire

When you complete your retirement papers, you can apply online for Medicare. This is regardless if you are (or not) receiving retirement compensation. Although you may have an employer-provided policy, it will probably leave gaps that are not covered. If you are currently self-employed or unemployed, you can still be Medicare-eligible. It is possible that your spouse will continue to receive benefits through an employer-provided plan, while you have reached age 65. Your spouse can also enroll in a Marketplace plan while you are receiving Medicare and/or Social Security benefits.

Depending on the type of treatment you receive, you are likely to incur some expenses that you will have to pay out-of-pocket. Determining whether a Medigap plan is cost-effective in your situation is one of the important services we provide. We provide accurate and unbiased reviews, with annual updates. If your prescriptions change, an adjustment to your Part D coverage (drug prescriptions) and/or basic Medigap plan may be applicable. Drug formularies provided by carriers are also subject to change. A complete list of covered drugs is provided annually by the carrier.

Each year, Part D prescription coverage options should be compared to ensure your coverage minimizes your out-of-pocket expenses. Costs of drugs may change, new cheaper generic drugs may become available, or your physician may determine that your prescriptions should be altered. Note: In addition to your prescription drug benefits, you are permitted to also use the popular GoodRx card. Other price comparison options are Optum Perks, Costco, BuzzRx, WellRx, and SingleCare.

It is very possible that you simply will not need any type of additional coverage, especially if you have comprehensive employer-provided Medigap benefits. However, your spouse may not be offered the same benefits, or, his/her cost may be much more expensive than yours. Also, an existing plan may be discontinued or become unavailable in your service area.

Medicaid Eligibility

If you are eligible for Medicaid in Indiana, you should consider applying for benefits (assuming you have not reached 65 yet). Medicaid provides comprehensive preventive and major medical coverage for both adults and children (CHIP). Expansion has been effective by including more lower-income households that can qualify for a policy. As your income increases, you may become eligible for a federal subsidy for purchasing a Marketplace plan.

Eligibility is dependent on many factors, including your age, household income, assets, and current medical conditions and needs. Hoosier Healthwise, Hoosier Health Connect, Healthy Indiana Plan (HIP) and standard Medicaid are the four options. Annually, you should review the eligibility requirements, since changes in household income or the number of covered persons could impact your options. New plans may also have become available in your area.

Available Companies

Dozens of companies offer Medicare Supplement coverage in Indiana. Some of the more recognizable 2026 insurers are Anthem, AARP (UnitedHealthcare), Aetna, Cigna, Capitol Life, Colonial Penn, Everest, Globe Life, Humana, Lumico Life, Medico, New Era Life, Pekin Life, State Farm, Transamerica, United American, and USAA.

However, many consumers are not familiar with most of the 50 carriers that sell plans in the state. Some of the lesser-known companies include: Assured Life, Bankers Fidelity, Erie, Federal Life, GPM Life, Guarantee Trust Life, Manhattan Life, National Health, Pan-American, Pekin Life, Physicians Life, Puritan Life, Resource Life, and United States Fire. We also provide a complete list of companies licensed to offer policies in the state. To obtain the pdf file, simply contact us.

We help you understand the differences in the rates each company offers. “Select” policies should also be considered since premiums can be lower. In exchange for paying lower rates, you will have to utilize specific hospitals and live within designated service areas. Not all residents will be able to purchase this type of policy.

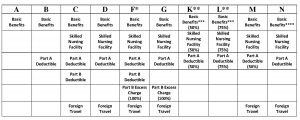

The state approves 12 different policy options, so there are many available choices. It is also important to understand how your premiums are calculated. There are three methods (issue age, attained age and community rated) utilized to determine your rate. Depending on your specific income and medical conditions, selecting the most suitable option could potentially save thousands of dollars over your lifetime.

Issue Age determines your rate based on the age at the time of application. The longer you wait to apply for coverage, the higher the price increases. Attained Age also determines your rate based on the age at the time of application. However, the price gradually increases each year, as you get older. Initially, premiums are the cheapest option. Community rated assumes the same rate with no medical underwriting, regardless of age.

Important Point: You do not purchase these policies through the newly-created Exchanges. The “Marketplace” is for applicants under age 65 and extensive information is available here. Financial aid is offered to qualifying individuals or families. Special Enrollment Periods (SEP) are available for exceptions. Obamacare subsidies are applicable for qualified individuals and families under age 65.

Sample Indiana MedSup Rates

Listed below are sample monthly rates from selected major companies for a 65-year-old non-smoking male in the Fort Wayne area (Allen County). Female prices are slightly different. Complete listing of benefits and exclusions should always be reviewed.

$31 – New Era Life High Deductible Plan G

$35 – United American High Deductible Plan G

$37 – Banker’s Fidelity Life High Deductible Plan G

$38 – Mutual Of Omaha High Deductible Plan G

$38 – United States Fire High Deductible Plan G

$39 – Allstate High Deductible Plan F

$39 – Bankers Fidelity High Deductible Plan F

$45 – Humana High Deductible Plan F

$76 – Allstate Plan N

$80 – SBLI USA Life Plan N

$80 – Ace Property And Casualty Plan N

$81 – United States Fire Plan N

$82 – AFLAC Plan N

$83 – American Benefit Life Plan N

$84 – Mutual Of Omaha Plan N

$88 – AARP-UnitedHealthcare Plan N

$90 – Elips Life Plan N

$92 – Cigna Plan N

$94 – Humana Plan N

$98 – Allstate Plan G

$105 – Manhattan Life Plan G

$111 – American Benefit Life Plan G

$117 – Elips Life Plan G

$127 – Allstate Plan F

$129 – Manhattan Life Plan F

$134 – AFLAC Plan F

$139 – Anthem BCBS Plan N

$143 – Humana Plan F

$149 – New Era Life Plan F

$166 – Capitol Life Plan F

Parts A,B,C, and D

There are four major parts of Medicare Coverage and we briefly review them below:

Part A provides hospital inpatient care benefits and home health care (subject to limitations and your doctor’s order). Hospital benefits include the semi-private room, meals, and rehab services. Coverage is also provided for inpatient care in a nonreligious nonmedical institution. Also included is hospice and skilled nursing facility coverage. Hospice benefits include symptom management and pain relief, homemaker services, selected durable medical equipment, and prescription drugs.

Usually, when you reach age 65, you become eligible for Part A. If you aren’t eligible (the free and automatic option), you may be able to purchase benefits. You are required to pay for the first three pints of blood. However, donations from local blood banks may be used without any out-of-pocket expense.

Part B provides benefits for outpatient expenses and services provided by a doctor. Limited preventive benefits are included along with physical and occupational health care coverage. You should enroll in Part B when you are eligible. The government typically pays most of the Part B premium (roughly 75%). It’s important to enroll when you are eligible to avoid a late sign-up fee.

Part C consists of Medicare Advantage plans that are private coverage provided by health insurers that includes the standard benefits. Preventive physical exams and some RX benefits are also included. Often, the money you pay out of pocket for Advantage plans is less than standard options. HMO, PFFS and PPO are the three available options.

When you elect this type of coverage, Medicare pays a private insurer each month for your health care. However, there can be different out of pocket costs, depending on the policy and the insurer. So it also is a good idea to properly shop and compare costs and benefits. Offering companies also must be approved by Medicare.

Part D is your prescription coverage and it is 100% optional. That is, if you don’t request this benefit, you will not receive it. You can enroll by completing a form that can be provided by a licensed broker. Rates will vary from one insurer to another, so getting help to shop for the best option is helpful.

Typically, you must meet a deductible for benefits begin. Once that has been met, a copay or coinsurance is paid on your prescriptions, which covers most of the cost. At some point, you may have to pay all of the costs, which are referred to as the “donut hole.” The initial phase of a drug plan is the “Deductible Phase.” Although amounts can vary by plan, the maximum allowed deductible is $445.

The “Initial Coverage Phase” is next, and continues until $4,130 is paid by the plan and beneficiary. Once $6,550 has been reached, the “Catastrophic Coverage” phase begins. Coinsurance and copays immediately reduce to 5% of the cost of the drug (or the higher of $8.95 for brand-name drugs and $3.60 for generic drugs).

A low income subsidy is available through the “Extra Help” program, with the benefits estimated at approximately $5,000 per year. An online application must be completed to determine your eligibility. US residency is required, and combined savings, real estate, and investments must not exceed $14,610 (single person) or $29,160 (married and living with spouse).

Medigap Supplement plans in Indiana must have the same features and benefits since they are heavily regulated by state and federal governments. This helps protect consumers and makes it easier to shop and compare benefits. Typically, these plans do not cover vision or dental benefits along with long-term care. Plans are “standardized” to help consumers shop and compare.

When you request a quote on our website, we help educate you with understanding different options, and selecting the plans that are most affordable. The prices you view are always the lowest available rates and identical to prices published on a direct-carrier website.

Although there are many options (A through N), most carriers do not sell all of these plans. However, an insurer that is actively offering coverage, must include Plan A among those plans. If they include other options in their portfolio, then plans C or F must also be one of the options. Of course, they can also sell any or all of the additional policies.

Occasionally, companies will add or subtract an existing plan from their portfolio. If this occurs, you are provided ample time to obtain alternative coverage. It is not uncommon for rates for Advantage plans to differ, depending upon the county where you reside. Thus, moving from one county to another may change the premium you pay and impact your out-of-pocket expenses.

Medicare Star Ratings

A Star Rating system is utilized by CMS (Center for Medicare and Medicaid Services) to review and compare quality and information. This applies to Prescription Drug, Advantage, and Cost plans. The five available ratings are 5-star (Excellent), 4-star (Above Average), 3-star (Average), 2-star (Below Average), and 1-star (Poor).

Advantage and Cost plans are judged in five categories: member complaints, member experience, staying healthy, chronic conditions management, and customer service. Plans that include prescription drug benefits are rated on drug safety and accuracy of drug pricing, customer service, member complaints, and member experience. Changes were made to 2021 and 2022 ratings

During the “Annual Election Period,” you can enroll in a 5-star plan. Within your service area, you may change to a 5-star plan during the SEP period of December 8th to November 30th. If you change to an Advantage plan without prescription drug benefits, you may lose those benefits. Several common plans and their Summary Star ratings (4.5 and 4.0) are shown below:

Indiana Medicare Advantage CMS Star Ratings

UnitedHealthcare Nursing Home Plan (PPO-I-SNP) – 5.0 Stars

AARP Medicare Advantage Choice Plan 2 (HMO-POS) – 4.5 Stars

AARP Medicare Advantage Profile (HMO-POS) – 4.5 Stars

AARP Medicare Advantage Plan 1 (HMO-POS) – 4.5 Stars

IU Health Plans Medicare Select (HMO) – 4.5 Stars

IU Health Plans Medicare Select Plus (HMO) – 4.5 Stars

IU Health Plans Medicare Choice (HMO-POS) – 4.5 Stars

AARP Medicare Advantage Patriot (PPO) – 4.0 Stars

AARP Medicare Advantage Choice Plan 2 (PPO) – 4.0 Stars

AARP Medicare Advantage Focus (PPO) – 4.0 Stars

Aetna Medicare Premier (PPO) – 4.0 Stars

Aetna Medicare Eagle (PPO) – 4.0 Stars

Aetna Medicare Value (PPO) – 4.0 Stars

Humana Gold Plus (HMO) – 4.0 Stars

Humana Honor (PPO) – 4.0 Stars

HumanaChoice (PPO) – 4.0 Stars

Humana Value Plus – 4.0 Stars

Medicare Advantage Options

Medicare Advantage policies have become very popular since they have limited out of pocket expenses and premiums are extremely low. A private insurer covers your Part A and B benefits. Four popular options are HMO, PPO, POS and SNP (Special Needs Plans).

The PPO (Preferred Provider Organization) is always a consumer favorite since you save money by utilizing network-provided doctors, hospitals and other facilities. You can go “out-of-network,” but you may incur higher expenses. You also do not need a referral to see a specialist. Prescription benefits are often included, but it’s important to verify specifics with a broker.

The HMO is a managed care option with a provider network unique to the carrier. A primary-care physician (PCP) is required to be selected, and they coordinate your healthcare treatment. HMO with Point-Of-Service (POS) allows you to utilize providers outside of the network, although out-of-pocket expenses are higher.

A Provider Sponsored Organization (PSO) is a managed care option that includes a provider network. A pcp is utilized, similar to an HMO. Religious Fraternal Benefit Society Plans are managed care programs may require its members to be part of their fraternity or religion. Private Fee For Service Plans (PFFS) create a cost schedule, although providers are permitted to bill 15% above agreed amount.

Several popular Medicare Advantage plans in Indiana include AARP Medicare Advantage Plan 1, AARP Medicare Advantage Choice Plan 2, AARP Medicare Advantage Patriot, Aetna Medicare Eagle, Aetna Medicare Prime, Aetna Medicare Value, Allwell Medicare, Allwell Medicare Boost, Anthem MediBlue Plus, Anthem MediBlue Extra, Ascension Complete St. Vincent Secure, CareSource Advantage Zero Premium, Health Alliance Medicare HMO Basic, Humana Gold Plus, Humana Honor, IU Health Plans Medicare Select, IU Health Plans Medicare Select, Humana Gold Plus, and UnitedHealthcare Dual Complete.

Medical Savings Account

A Medical Savings Account (MSA) option is offered by various companies and allows Medicare to transfer funds into your account. It’s a combination of a “High-Deductible” plan (Plan C) and a separate savings account. Different deductible amounts are available. Once the deductible is met, covered benefits are paid with no out-of-pocket expenses. They are similar to HSAs offered to applicants under age 65.

These plans include benefits that are typically covered by other Advantage contracts. Additional options (usually for a small cost) include vision, dental, and long-term care. Drugs are not covered, although accumulated funds inside the account can be used to pay for prescriptions.

Once you have selected an insurer for coverage, a bank account is created for Medicare deposits. Money spent inside the account for Part A and Part B expenses is applied towards the deductible. You are only responsible to pay the Medicare-approved amounts if your deductible has not been met yet. Funds remaining in the account at the end of the year will not be lost, and can be used for qualified future expenses.

What If I Am Considered Uninsurable?

If you buy a Medigap policy during an “Open Enrollment” period, you will not be asked any questions pertaining to your health and you will not be charged a higher premium because of any existing or past medical problems. Also, you will be able to purchase any policy that is currently being offered by that insurer. There also may be “guarantee issue” situations where you are automatically approved.

Open Enrollment

This window of opportunity is a six-month period that starts from the first day of the calendar month that you are signed up for Part B and you are at least 65. However, a pre-existing condition may not be covered for the first six months of the newly-issued policy (waiting period) if it was treated or diagnosed in the prior six months.

If you don’t need benefits yet (because you are covered under your wife’s employer-provided policy), you are not required to enroll. You can wait until your existing plan (group through spouse) is going to terminate, and enroll in Medicare Part B. This will immediately make you eligible for Open Enrollment.

Comparing Indiana Medicare Supplement Plans is not easy and can be very confusing. We understand how difficult the process is. That’s why we take the time to clearly explain your options and provide free quotes from the most reputable insurers, so you can feel comfortable about the plan you select.